Understanding the Distinctions Between Banks and Credit Unions

In the realm of financial institutions, banks and credit unions are two common options for individuals seeking financial services. While they share similarities, such as providing financial products and services, there are distinct differences between the two. This article aims to shed light on the disparities between banks and credit unions, helping readers make informed choices about where to entrust their finances.

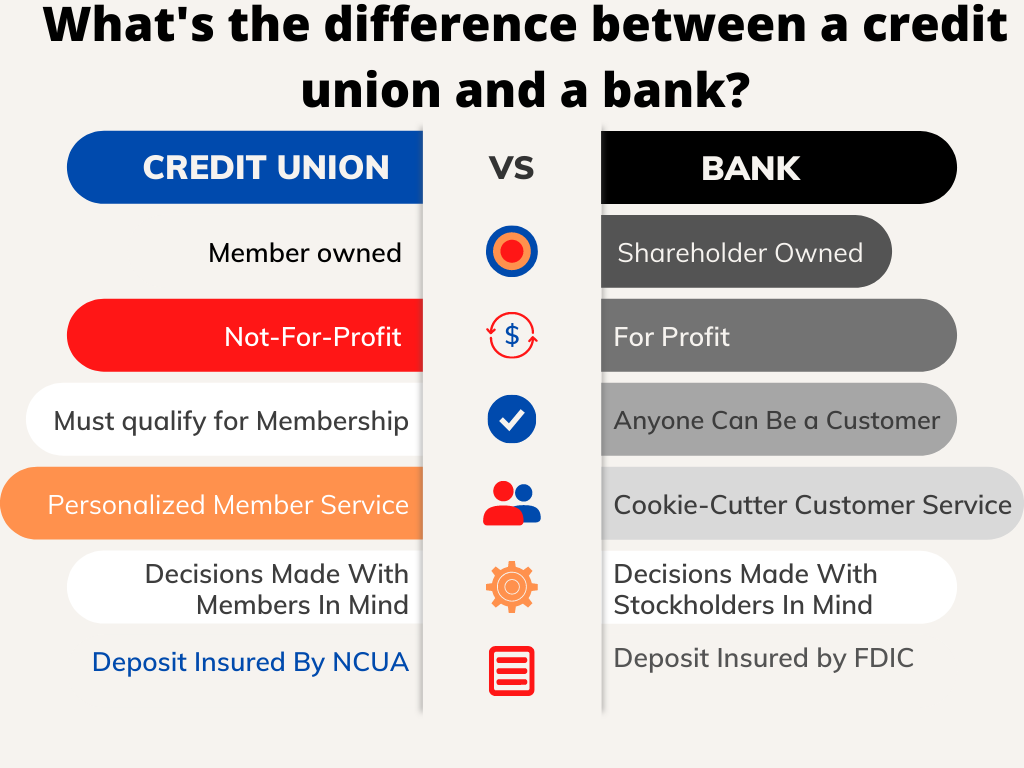

- Ownership Structure – One of the fundamental contrasts between banks and credit unions lies in their ownership structure. Banks are for-profit institutions, typically owned by shareholders or private individuals. Their primary goal is to maximize profits for shareholders. In contrast, credit unions are not-for-profit cooperatives owned by their members. This cooperative structure allows credit unions to prioritize their members’ needs, often resulting in better rates, lower fees, and personalized customer service.

- Membership Eligibility – Banks and credit unions differ in terms of membership eligibility. Banks are open to the general public, allowing anyone to become a customer by meeting the bank’s requirements, such as age, identification, and minimum deposit. In contrast, credit unions have membership criteria based on a common bond, such as a specific employer, profession, or geographic area. This shared affiliation ensures that credit unions serve a specific community, fostering a sense of unity and cooperative values among members.

- Governance and Decision-Making – The governance and decision-making processes of banks and credit unions also diverge. Banks are typically managed by a board of directors appointed by shareholders, often focused on maximizing profits. Credit unions, on the other hand, operate under the “one member, one vote” principle. Each member has an equal say in electing the board of directors and influencing the institution’s direction. This democratic approach allows credit unions to align their policies and services closely with the needs and preferences of their members.

- Products and Services – While both banks and credit unions offer a range of financial products and services, there can be variations in their offerings. Banks tend to have a broader scope, providing diverse options such as mortgages, credit cards, investment services, and business loans. Credit unions, although typically smaller in scale, often focus on personalized service and meeting the needs of their specific membership base. They may offer competitive rates on savings accounts, loans, and other financial products, catering directly to the interests of their members.

- Profit Distribution – As for-profit institutions, banks distribute their earnings among shareholders in the form of dividends and reinvestment. In contrast, credit unions operate on a not-for-profit basis, with any surplus funds being reinvested back into the credit union to enhance services, improve rates, or strengthen reserves. This approach enables credit unions to provide members with more favorable rates, lower fees, and community-focused initiatives.

While banks and credit unions both serve as financial institutions, their differences in ownership structure, membership eligibility, governance, and profit distribution are significant. Banks emphasize profitability and cater to the general public, whereas credit unions prioritize their members’ needs and foster a sense of community. Understanding these distinctions is crucial when selecting a financial institution, as it allows individuals to align their financial goals with an institution that best meets their needs and values.